Financial security is essential for returning citizens to succeed upon reentry. Regardless of your level of income, financial literacy will help you meet your basic needs, provide for your family, and save towards your future goals.

Create a plan while still in custody

Returning citizens often face significant financial challenges upon reentry. Take full advantage of your time in custody and all the resources your facility offers before being released.

Treatment – Individuals in prison may continue to struggle with drug abuse and mental illnesses, which can lead to recidivism post-release. Be sure to take advantage of all treatment resources offered at your facility.

Education – Pursuing an education while incarcerated can help you transition back into society more successfully. Having an education can help you secure employment and a higher income. While incarcerated, use the resources available to educate yourself to the greatest extent.

Job training – Take advantage of job training and certification programs offered at your facility to strengthen your job skills.

Documentation – If you do not already have an ID, Social Security card, and Birth Certificate, be sure to get copies before your release. You will need them to apply for housing, work, and education.

Housing – It is important to think about where you will be living post-release. Living with a family member or a friend may be an option for some. If not, there are many housing options available to returning citizens, including public, private, supportive, and transitional housing.

Start saving money right away – While prison jobs are typically very low-paying, try to save as much as you can afford to. Even small amounts will add up over your time in prison and you will need as much money as possible when you are released.

Even if you are already in custody, our Voluntary Surrender Guide has tips to help you use your time wisely.

Update Your Documents

Upon your release you may need to update some of your personal documents to include your new contact information, including:

- Driver’s license/ID Card

- Passport

- Account details for banks, insurance companies, government services, bills, utilities, etc.

If you need to obtain copies of identifying documents, our Reentry Resources page has links for every state and major U.S. territory.

Ask your probation/parole officer if there is any additional documentation they require of you.

Build or restore your credit

Your credit score can have significant implications for your ability to acquire loans and lower interest rates, so it is important to know how to restore and maintain your credit post-incarceration.

While still in custody:

- Add a family member to your credit card as an authorized user. They can pay for a monthly subscription for you and pay it off each month so your credit stays active.

- Incarcerated individuals can oftentimes be the targets of identity theft. Freeze your credit to prevent scammers from opening up new lines of credit in your name and damaging your credit.

- Check your credit score to find out if you have any issues that are hurting your score such as debts or reporting errors. You can request a free credit report by mail using a Credit Report Request Form or have a loved one request one online.

- Dispute any errors in your credit report. Under the Fair Reporting Credit Act, credit disputes must be investigated and removed if the report cannot be proven to be correct.

- Request your consumer score and consumer disclosure from Chexsystems by mail using the Chexsystems Report Request Form or have a loved one request it online.

Post-release:

- Get a credit card if you do not already have one. If you do not qualify for a standard (unsecured) credit card, a secured credit card is a good way to rebuild your credit until you can get an unsecured credit card.

- Don’t overspend. Try to keep your credit utilization low by spending less than 30% of your available monthly credit limit.

- Don’t make only the minimum payment amount each month. Paying off more than the minimum amount each month keeps utilization low and helps you avoid accruing too much interest.

Work with a debt counselor

Prior to, or during incarceration, you may have accumulated some debt in the form of child support, legal fees, loans, etc. Although you may not have been able to pay your debts while incarcerated, creditors will still expect payment. Working with a debt counselor can help you pay off your debts.

Low cost or free organizations that offer financial counseling for justice-impacted individuals:

Apply for government assistance

Transitioning home from prison can be difficult. Government assistance programs can be a valuable resource to help with financial needs, and can come in the form of income assistance, housing, food, healthcare, etc.

SSDI and SSI – Social Security Disability Income and Supplemental Security Income will provide an income for you and certain family members if you are unable to work due to a disability that will last for at least a year or result in death, and if you have worked for the required amount of time and paid social security taxes.

Budgeting

Creating a budget is very useful for keeping track of your earnings, savings, and payments. By creating a budget, you can figure out how much money you have left after all of your expenses each month and use the rest of the money left over to save, either in general or for a specific goal. You can also set aside extra money for payments if you are trying to pay off any debts.

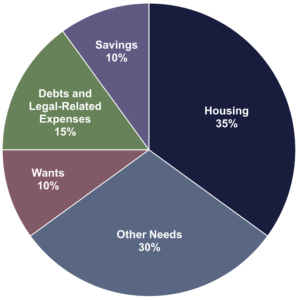

The following budget structure is ideal but may not be possible for everyone, especially when first returning from incarceration. While this is the goal, save as much as you are able.

Suggested Monthly Budget

Follow this suggested breakdown of your monthly expenses as closely as you can.

If you don’t have any debts or legal-related expenses, you can reassign that portion of the budget wherever necessary.

If taxes are not automatically taken out of your paychecks, you will need to calculate how much you will owe and set aside that amount each month.

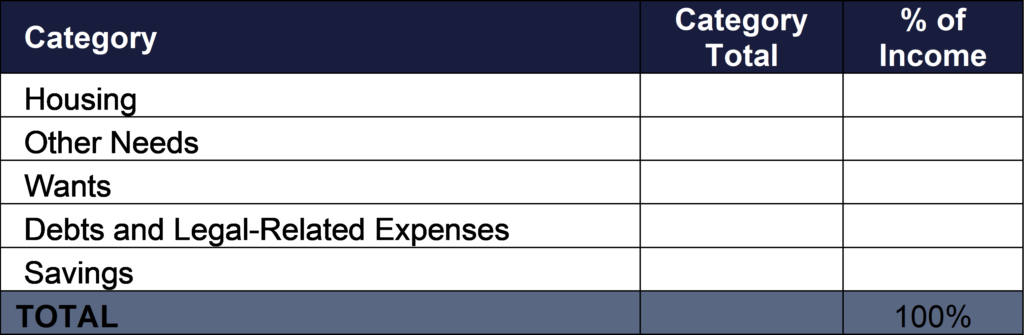

Budget Tracker

The first step to budgeting your money is to track your income and expenses for 30 days.

Create a categorized budget for all of your monthly expenses. The goal is to get your budget structure as close as possible to the above pie chart.

Calculate the percentage of your income you spend on each of these categories by dividing the category total by your total income.

For example, if your total expenses for housing was $1,200 and your total income was $3,500 this would be your calculation: 1200 ÷ 3500 = .342 or 34%

Saving

One of the keys to long-term financial security is effectively saving your money. By saving, you are able to create an emergency fund in case of any unforeseen expenses. You are also able to save for retirement and potential investments for your future.

Tips for saving

- Set up a dedicated savings account and contribute a portion of your monthly income into it.

- Cut out any unnecessary expenses and find ways to reduce costs so you can free up more money each month to save.

- Create separate funds for any financial goals you have so you can control how much money you put into those goals as well as your savings account month to month.

- If you set up a budget, you can determine how much you can contribute to savings each month and make sure that you make those contributions before you spend the money on something else.

- You can use a bank account comparison tool to compare bank accounts and determine which one is the best option for you.

Manage your workplace benefits and retirement benefits

- Many employers offer a retirement account such as a 401(k) to help employees save toward retirement. Participating in this plan allows you to contribute a certain percentage of your paycheck (usually pre-taxed) to fund your retirement plan.

- Some companies will match up to a certain percentage of retirement contributions. Take full advantage of this offer.

- Sign up for automatic deductions from your paycheck to avoid skipping retirement plan payments.

Income annuities to save for retirement

- Income annuities provide lifetime monthly income regardless of the stock market.

- If you have money saved and are retired or close to retirement, you can use income annuities to turn your money into payments that will last your lifetime with a monthly, quarterly, semi-annual, or annual payout.

- Talk with a financial advisor to find the best annuity option for you or view these resources for more information.

Loans

A loan is borrowed money that must be paid back, usually with interest applied. The benefits of loans include building your credit score, faster funding, capitalizing on investment opportunities, and more. There are many forms of loans such as student, home, business, and car loans. When considering a loan, be sure to compare options to ensure you get the best deal. Keep in mind that you will eventually have to pay back more than the amount you borrowed.

Student Loans

A student loan is money that is borrowed specifically to pay for education. As with all loans, this must be paid back with interest applied. Try to avoid student loan debt by applying for scholarships and grants.

- Pell Grant – Money that is given to undergraduate individuals who have financial need for education. The Pell Grant is an award and does not need to be paid back. For more information on the Pell grant, see our Reentry Education Guide.

Home Loans

A home loan, or mortgage loan, is money borrowed from a lender that you can use to purchase a home.

Car Loans

A car loan is money borrowed to purchase a car. This can be provided by the car dealer or a third party.

Business Loans

A business loan is money borrowed from a lender to be used to start or increase funding to a business. If you can, try to look for business grants before applying for a loan.

Business Grants

A business grant is money that is given to a company for their operational costs, development, research, etc. Unlike a loan, money awarded for a grant does not have to be paid back.

Helping small businesses thrive.

Helps justice-impacted individuals find grants for their small business.

Provides small business owners capital for advancing their business.

Provides a private grant for individuals who want to start a business.

Insurance

Insurance offers financial protection in the case of unexpected expenses. You make regular payments, called premiums, to an insurance plan in the agreement that if a covered emergency occurs the insurance company will pay the costs. There are many different types of insurance.

Car Insurance

Having car insurance is required by law and can protect you financially in cases of motor vehicle damage, accidents, or theft. If you are pulled over or are involved in an incident and have no insurance, this can increase your financial burdens by incurring fees & fines, license suspension, car impounding, and/or jail time and violation of probation/parole. Car insurance laws vary by state, and car lenders may also have their own requirements. Find the car insurance requirements in your state:

Insurance Information Institute

Car insurance requirements by state.

Health Insurance

Medical, dental, and vision insurance can cut the cost of health-related expenses. If your employer does not offer this benefit you can apply on your own.

The government offers free or low-cost health insurance in some circumstances.

If you have low income you may qualify for Medicaid.

If you are 65 or older you may qualify for Medicare.

Affordable Care Act – If you do not meet eligibility requirements for Medicaid or Medicare look into health insurance coverage with the Affordable Care Act at Healthcare.gov. This provides significant needs-based financial assistance for purchasing coverage.

ACA Special Enrollment Period – Enrollment is typically only open at the end of the year but justice impacted individuals are eligible to enroll within 60 days from the time of release from prison.

If you do not qualify for free or subsidized health insurance, compare the services and rates of private insurance providers and select the right fit for you. Explore your options online with a keyword search such as “affordable top [health, dental, vision] insurance providers in [enter state name].”

Prescription Assistance

Even with health insurance, some prescription medication can be expensive. Rx Saving Cards can lower the cost of prescriptions and also point you in the direction of the pharmacy that charges the lowest amount. This can help you maintain your mental, physical, and emotional health.

Free Rx Savings Cards:

Life Insurance

Life insurance is a way to provide some financial security to your loved ones in the event of your death. Justice-impacted individuals may be required to pay higher premiums and may not qualify for all types of policies. Consult with a life insurance advisor or search online with keywords such as “reputable life insurance companies in [enter state name].” More information can also be found here:

Cell Phone

Cell phones, specifically smart phones, make it easier to keep track of your bank accounts, purchases, and possible fraudulent activity. There are several options available for low-cost phones and plans:

Beware of Scams

If you have been incarcerated for a significant period of time, it is important to be aware of how scams work and what kind of scams are out there so you can avoid them. Regardless of your financial situation post-incarceration, scammers could be a real problem.

The Federal Trade Commission offers four common signs that something is a scam

- The scammers pretend to be from an organization you would know. Scammers may contact you pretending to represent a government agency, a company, or a charity. The contact information you receive when they call you may be fake.

- The scammers will try to convince you that you either have a problem you need to have fixed by them or that there is a prize that you can receive from them. They may try to convince you that you owe money to the agency or company they are pretending to represent. They may also try to convince you that an account or subscription of yours is in trouble so they can extract account information from you.

- The scammers will try to convince you that you need to act immediately or there will be immediate ramifications such as legal action.

- The scammers will want you to pay only in a certain way. They may ask you to pay in cryptocurrency, gift cards, or through an app such as CashApp.

Source:

Specific scams that you should be aware of

- Early release scams – Scammers will contact the family of an incarcerated person and try to convince them that they can pay to have their incarcerated family member released from prison early because of “newly passed laws”.

- Predatory loans – Predatory lending is the practice of imposing loan terms that are immoral. This could include high interest rates, large fees, equity stripping, etc. Be wary of language like “guaranteed approval”.

- Credit repair scams – If you are trying to rebuild your credit post-incarceration you may run into a credit repair scam in the process. This scam involves offering debt counseling and credit repair services that will fix your credit. They will ask for money up front and will not deliver on their services.

- For-profit universities – Often seen in television commercials and in ads, these schools have a history of misrepresenting the value of their programs and are often overpriced. States may have programs where you can find more affordable or maybe even free programs for certificates and degrees. See our Reentry Education Guide for more information on higher education and certificates.

- Online GED scams – The GED Testing Service is the only legitimate provider of GEDs and online GED tests. Other organizations online that offer GED certificates in exchange for money are not legitimate.

Tips for avoiding scams

- Avoid giving out personal information if you suspect you are being contacted by a scammer.

- Avoid acting immediately.

- If you are suspicious of a call, get their name and tell them you will hang up and contact the number that you have on file for the organization and ask to be transferred to the name of the caller. If the call is legitimate, you will be right back in touch with them. If not, you will know that it was a scam call.

- If you are contacted by email or text message, avoid clicking any links until you are able to confirm with the organization that it was a legitimate message.

Clear your criminal record if possible

Clearing your criminal record, if eligible, presents many benefits such as increasing your chances of:

- Obtaining housing

- Accessing public benefits

- Qualifying for loans

Visit our How to Clear Your Criminal Record for more information: